Thursday, January 19, 2023

Thursday, January 19, 2023

Regardless of whether you closely follow the economy or not, chances are you’ve heard whispers of a coming recession. Economic conditions are determined by a broad range of factors. So, let’s lean on the experts and what history tells us to see what could lie ahead. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“Two-in-three economists are forecasting a recession in 2023 . . .”

As chatter about a potential recession increases, you may wonder what a recession could mean for the housing market. Here’s a look at the historical data showing what happened in real estate during previous recessions. This data reinforces why you shouldn’t be afraid of what a recession could mean for the housing market today.

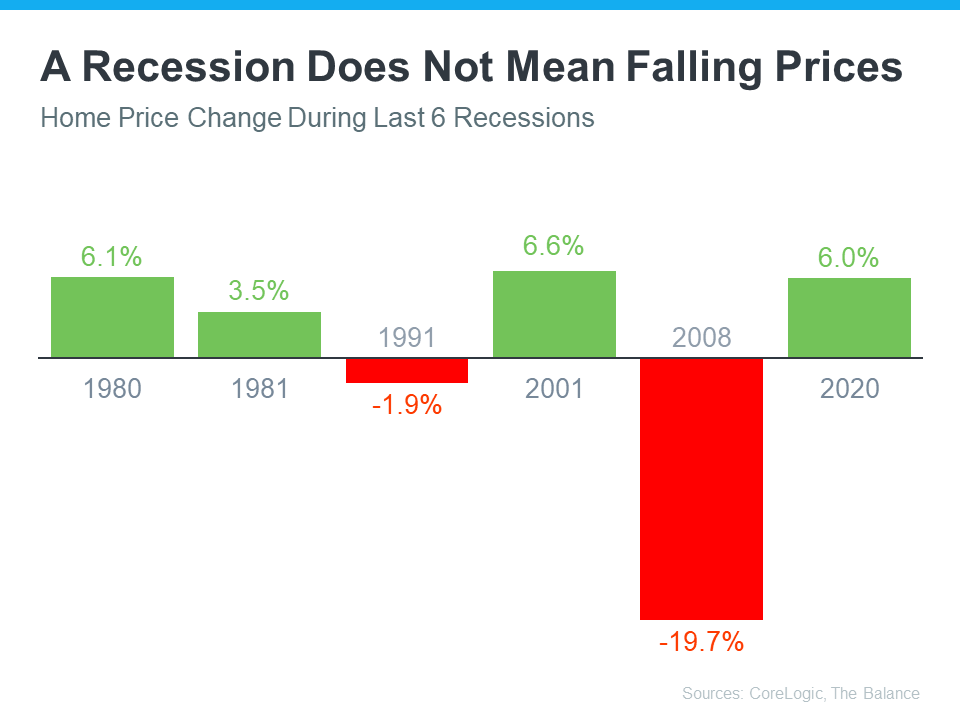

A Recession Doesn’t Mean Falling Home Prices

To demonstrate that home prices don’t fall every time there’s a recession, it helps to review historical data. Reflecting on recessions back to 1980, the graph below illustrates that home prices appreciated in four of the last six of them. So historically, when the economy slows down, it doesn’t automatically that mean home values will always fall.

Most people remember the housing crisis in 2008 (the larger of the two red bars in the graph above) and presume another recession would be a repeat of what happened to housing prices then. But today’s housing market isn’t about to crash because the fundamentals of today’s market are different than they were in 2008. According to experts, home prices will vary by market and may go increase or decrease depending on the local area. Regardless, the average of their 2023 forecasts shows prices will net neutral nationwide and not fall drastically like they did in 2008.

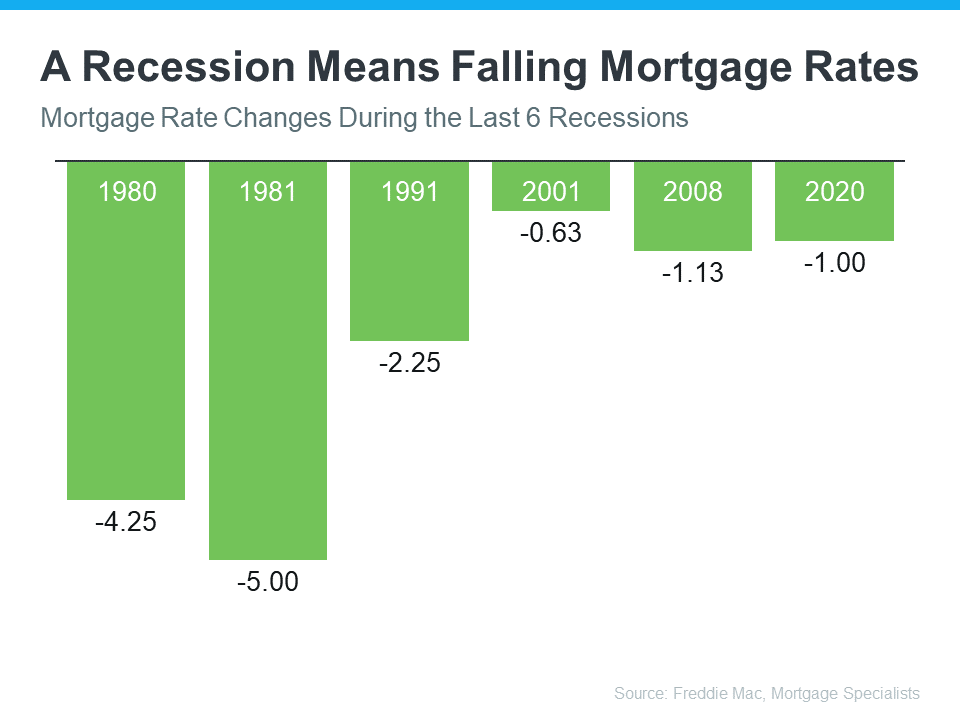

A Recession Means Falling Mortgage Rates

Research also helps to paint the picture of how a recession could impact the cost of financing a home. Historically, as the graph below shows, each time the economy slowed down, mortgage rates decreased.

Fortune explains that mortgage rates typically fall during an economic slowdown:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

In 2023, market experts predict that mortgage rates will likely stabilize below the peak we saw last year. That’s because mortgage rates tend to respond to inflation. And early signs show inflation is beginning to cool. If inflation continues to ease, rates could fall a bit more, but the days of 3% are likely gone. The big takeaway is there’s little need to fear the word recession when it comes to housing. In fact, experts suggest that a recession would be mild and that housing would play a key role in a quick economic rebound. As the 2022 CEO Outlook from KPMG, says:

“Global CEOs see a ‘mild and short’ recession, yet optimistic about global economy over 3-year horizon . . .

More than 8 out of 10 anticipate a recession over the next 12 months, with more than half expecting it to be mild and short.”

Bottom Line

While history doesn’t always repeat itself, we can certainly learn from the past. According to historical data, in most recessions, home values have appreciated and mortgage rates have declined.

So, if you’re considering buying or selling a home this year, let’s connect so you have expert advice on what’s happening in the housing market and what that means for your homeownership goals.

Courtesy of Keeping Current Matters